Medicare Advantage Overview

Medicare Supplement Plans (Medigap)

What is Medicare Supplemental Insurance?

Medicare Supplemental Plans Coverage

Medicare Supplements Plans – Standardized Plans

What are the different Medicare Supplements Plans?

How do I pick a Medicare Supplement plan?

Medicare Supplemental Plans – Open Enrollment

Medicare Supplement Plans – Guaranteed Issue

Medicare Supplement Plans- Underwritten

What is the Best Medicare Supplemental plan?

Common Questions about Medicare Supplemental Insurance

What is the open enrollment period for Medicare supplemental plans?

Can you change Medicare supplements anytime?

What is guaranteed issue for Medicare supplemental insurance?

Medicare Supplement Plans (Medigap)

Medicare Supplement plans cover 13.5 million Medicare beneficiaries. Also referred to as Medigap plans, these policies help pay for your share of Medicare expenses, such as your deductibles and co-insurance. Medicare supplement insurance plans are available for purchase in all 50 states and are very popular with people who want little to no copays when they access healthcare services.

Many people new to Medicare feel surprised to find that Medicare covers only 80% of your Part B expenses. The other 20% can be devastating to you financially if a serious illness arises. You can choose a Medicare Supplement that will pay some or all of that 20% for you, among other things. Supplemental insurance for seniors with Medicare essentially buys you peace of mind by eliminating that cost-sharing responsibility.

MEDICARE SUPPLEMENT (MEDIGAP)

DOCTOR BILLS

Your doctor provides a medical service and bills Medicare

MEDICARE PAYS

Medicare pays the approved portion of the bill and sends the excess amount to Medigap

MEDICAL PAYS

Your Medigap plan pays the excess amount left over, according to the plan’s terms

Medicare Part B only covers 80% of your medical expenses. Medicare Supplement (Medigap) plans help pick up the excess costs.

Also, during your one-time open enrollment window, you are guaranteed the right to purchase a Medicare supplement plan. Your health status does not matter when you buy a plan during this six-month window.

What is Medicare Supplemental Insurance?

Medicare Supplements were offered to the Medicare Beneficiaries shortly after Medicare was signed into law. Since Medicare has internal coverage gaps, making consumers that have Medicare only cover part of the cost, Medicare Supplements allowed consumers to purchase insurance through private Insurance companies, lowering or doing away with these additional costs. These plans have allowed people to worry less about unexpected costs, while keeping their premium level.

Some of the primary advantages of a traditional Medicare supplement policy are:

- Freedom to choose your own doctors and hospitals

- No referrals required to see a specialist

- Predictable out-of-pocket expenses for Medicare-covered services (and zero out-of-pocket with Plan F)

- Nationwide coverage – you can use it anywhere in the United States

- Guaranteed renewability – the insurance company can never drop you or change your coverage due to a health condition

Supplemental insurance for seniors with Medicare is the most predictable back-end coverage that you can buy. You will know exactly what’s covered for every inpatient or outpatient procedure based on which Medigap plan you choose.

Some of the primary advantages of a traditional Medicare supplement policy are:

- You must have Part A and Part B to buy a Medigap policy.

- Medicare supplement plans cover only one person. Your spouse must have his or her own individual policy.

- You can drop your supplement at any time. There is no annual election period for Medicare Supplement plans.

- The annual election period in the fall is for drug plans. It does not apply to

- Medicare supplements in any way.

- Many carriers offer household discounts if two or more people enroll in

- Medicare supplemental plans from the same company

- Plans do not include Part D, so you’ll add a separate standalone Part D drug plan

Medigap is insurance to cover your Medicare deductibles & copays

Medicare Supplemental Plans Coverage

Medicare Supplement plans pay after Medicare approves and pays its share of your claim. They are Medicare gap insurance, helping to cover the gaps in Medicare that normally you would have to pay. This includes things like deductibles, coinsurance and copays.

You can use your Medicare Supplement plan at any provider in the nation that accepts Medicare. This makes Medicare supplements great for travel or for people who live in more than one state throughout the year.

Medicare Supplements plans do not include retail drug coverage, so you’ll want to purchase a standalone Part D drug plan for your medications. A Medicare Supplement does not cover routine, dental, vision or hearing services either. Since Medicare itself does not cover these items, so your supplement cannot pay anything toward them either.

Medicare Supplements Plans – Standardized Plans

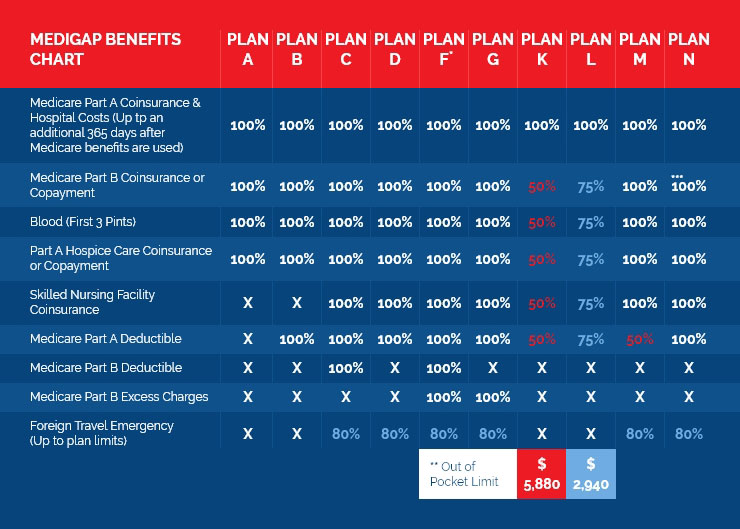

To see a list of all the Medicare supplemental plans available – take a look at our Medigap supplement chart below. This chart appears in the “Choosing a Medigap,” booklet published by Medicare itself. It details the benefits covered by each different plan. If you would like a copy for yourself, please request information to your right and we will provide a free copy for your review.

Some of our clients have found Medicare’s handbook hard to read, so here on our site, we’ve tried to use simpler terms. Our pages about the different Medicare supplements include examples of how the coverage would pay. This will help you understand how they work in real situations.

*Medigap Plan F is also offered as a high-deductible plan (HDF) by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the deductible amount of $2340 in 2020 before your policy will pay anything.

**For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible ($198 in 2020), the Medigap plan pays 100% of covered services for the rest of that calendar year.

***Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission. You can find this chart as well as other great info in Medicare’s Choosing a Medigap booklet as well, which you can find here.

****Medigap Plan G also has a high-deductible option. In 2020, the HDG deductible is $2340. To learn more about this plan, fill out the contact form and one of our Professionals will gladly walk you through any and all questions you have regarding this plan.

What are the different Medicare Supplements Plans?

Each Medicare supplement plan in the chart above has a letter, A – N. Each plan letter provides a different set of benefits. However, each lettered plan must have the same standardized coverage regardless of which insurance company you choose. For example, Medicare supplement Plan G through Humana will be the same benefits as a Plan G through Anthem or United Healthcare.

The Medicare supplement chart below shows the 10 standardized Medicare supplement plans. These plans can be offered by insurance companies in most states. Wisconsin, Minnesota and Massachusetts have different options though.

There is one supplemental insurance plan that covers ALL OF the gaps, leaving you with nothing out of pocket, like Plan F. There are others where you agree to do some cost-sharing and in return you get a lower monthly premium. If you prefer something like this, in the middle, you could look at Plans G or N where you pay a few things yourself, in exchange for lower premiums.

An insurance agent who specializes in Medicare supplemental insurance for seniors with Medicare can help you determine which one best suits you.

How do I pick a Medicare Supplement plan?

Most people enroll in Medicare supplement plans F, G or N. That’s because these offer the most coverage. However, the reason for the choices is to let you decide what is most important to you. Some beneficiaries want a plan that covers all the gaps and leaves them with no worries about the cost of medical procedures. Other beneficiaries prefer a Medicare supplement plan in which they cover some of their deductibles and copays out of pocket in order to achieve lower premiums.

There is no right or wrong here. Ask your broker to provide quotes for several plans and see what makes the most sense to you.

Medicare Supplemental Plans – Open Enrollment

Per Medicare’s Guide to Health Insurance, the best time to buy a supplement policy is during your one-time open-enrollment window. This window begins on the first day of your birth month, or the month that you enroll in Part B. It lasts for six months and is a “use it or lose it” enrollment period.

During your one-time Medigap open enrollment, the Medicare supplement company cannot ask you any medical questions. They cannot turn you down for any health conditions. They cannot refuse you a policy or charge you any additional amount due to health conditions, medications or pre-existing illnesses. You will have your choice of Medicare supplemental plans.

After this window passes, however, future insurance companies that you might apply with can accept or decline you based on health. That is why the handbook states that open enrollment is the best time to enroll.

Please note: the Annual Election Period in the fall is NOT a time when you can change Medigap plans with no health questions. Many people mistakenly believe this. The Annual Election period in the fall pertains to your Part D plan, not your Medigap plan.

Medicare Open Enrollment is a one-time window to enroll in any Medicare supplement plan in your area.

Medicare Supplement Plans – Guaranteed Issue

Some people delay enrollment into a supplement because they have group health coverage through an employer. Later when you retire or lose that coverage, you have the right to purchase certain Medigap policies within the 63 days following the loss of your group coverage. This is called your Medicare supplement guaranteed issue rights.

The guaranteed issue window works just like open enrollment, except that is a shorter period of time and that your plan choices are limited to Plans A, B,C ,F, K, and L. The insurance company cannot deny your application for any health reasons.

There are some other circumstances which create a guaranteed issue window as well, such as losing Medicare Advantage coverage when moving out of state. Guaranteed issue rules can vary by state, so be sure to check with a licensed agent who can inform you about the laws that apply in your state. Our agency is licensed in 48 states, so feel free to contact us if you would like for us to check for you.

You will want to keep any notices from your prior carrier that show proof of your creditable coverage for guaranteed issue and also so that you do not incur the Part D late enrollment penalty.

The Annual Election Period does NOT allow you to get a Medigap plan with no health questions.

Medicare Supplement Plans- Underwritten

If your window has already passed for open enrollment or guaranteed issue, you can still apply for a Medicare supplement, but you will have to answer some health questions on your application. The insurance company can accept or decline you.

MISSING YOUR OPEN ENROLLMENT

WHAT HAPPENS IF YOU MISS THIS CRITICAL ONE-TIME OPPORTUNITY?

You missed your one-time open enrollment (or guaranteed issue) period for Medicare supplement.

You can still apply for Medicare supplement but the carrier does not have to accept you.

They will ask you health questions and use that information to accept or decline your application.

Some people are confused by this because they believe the Annual Drug Election Period in the fall is a time when they can change their supplement without underwriting. Unfortunately, the autumn election period only applies to drug plans and Medicare Advantage plans. Changing Medigap carriers will require underwriting in most cases.

What is the Best Medicare Supplemental plan?

Medicare Supplement Plan F is the plan with the highest level of coverage for individuals that had Medicare Part A prior to January 1, 2020 will continue to have the option to enroll in plan F. For everyone that enrolled in Part A January 1, 2020 or later will be able to purchase the next best plan, which is a Plan G. Make sure to double check with a license Broker to make sure you choose the best possible option for yourself.

You can buy a Medicare supplement from a variety of different insurance companies. However, plans of the same letter are standardized so that the benefits are the same. A Medicare supplement Plan F with one company has the same benefits as the next company. Typically the only difference you will find between companies with offering the same standardized letter plan is price. Make sure you compare the options in your area each year you see rate increases on your existing coverage.

Medicare Supplemental Plan G is the next most comprehensive plan. It works exactly like Plan F except that you pay for the Part B deductible once per year. Your premiums will be lower though, and sometimes this creates annual savings. To find the best Medicare supplemental plan in your area, contact us for a free report that includes quotes and rate trend histories.

Since there are several standardized plans available to you in each state, you will want to think carefully about which one fits your needs the best.

Common Questions about Medicare Supplemental Insurance

What is the average cost of supplemental insurance for Medicare?

Pricing for Medicare supplement policies varies by state. We even see price differences from zip code to zip code in the same county. In some states like Florida, the premiums are higher because the cost of healthcare services in that area is higher. For example, we might be able to find a Plan G for a turning-65 female non-tobacco user for around $100/month in Texas while the same policy would cost more than twice that in Florida.

Most Medicare supplement companies also base their rates on gender, zip code, tobacco usage, and age. Some individuals may also benefit from household discounts. For quotes in your own zip code, give us a call at 1-855-954-0664.

What is the open enrollment period for Medicare supplemental plans?

When people first active Medicare Part B, they have 6 months to enroll in any Medicare supplement without health questions. The insurance company will approve your application with no pre-existing condition waiting period. We call this the open enrollment period Medicare supplements. It is a one-time window.

Be aware that the Annual Election Period (AEP) that occurs each fall is NOT a time when you can get a Medicare supplemental insurance plan with no health questions asked. The AEP has nothing to do with Medigap plans. Instead, it’s a time when you can change your Part D drug plan. When people first active Medicare Part B, they have 6 months to enroll in any Medicare supplement without health questions. The insurance company will approve your application with no pre-existing condition waiting period. We call this the open enrollment period Medicare supplements. It is a one-time window.

Can you change Medicare supplements anytime?

You can apply to change your Medicare Supplement at any time, but if you are past your open enrollment window, you will have to answer health questions in most states.

The Medicare supplement insurance company will review your health history and medication history. They can accept or decline you.

There are a few states where the rules are different. For example, California, Oregon, Connecticut and Washington have established exceptions to this rule.

What is guaranteed issue for Medicare supplemental insurance?

In certain circumstances, an insurance company must accept you for coverage without asking health questions. For example, if you are on Medicaid and you lose your Medicaid eligibility, you have a short window to apply for Medigap without health questions.

Another example would be for someone coming off employer health coverage that is primary to Medicare. They will have a short window to apply for certain Medigap plans under guaranteed issue rules.

Do I really need supplemental insurance with Medicare?

Supplemental is optional. However, without any supplemental insurance, you would be responsible for expensive hospital deductibles and copays as well as 20% of the cost of ALL outpatients services. This includes things like surgeries and chemotherapy which would be financially devastating without some form of supplemental coverage.

If you find that a Medicare supplement is out of your budget, then you should consider a Medicare Advantage plan, which has lower premiums because you agree to use a network of providers in your local area.

Find the Right Medicare Supplemental Insurance

When you buy your coverage directly from an insurance company, you give up a lot of benefits. Purchasing through Our Medicare Coach costs exactly the same, but we provide these FREE value-added services for our policyholders.

- What is Medicare : we explain your basic benefits first!

- Quotes for over 40 companies

- Free rate-trend history report so you can see which company has had the lowest rate increases

- Free financial ratings for each company

- Free claims support and help with appeals if Medicare denies a claim

- Full-time Client Service Team to answer your Medicare questions

- Exclusive Clients-Only Webinars each fall to go over the upcoming Medicare changes for next year.

Want more info? Check out our video on Medicare supplements here.

Don’t hesitate to contact our agency for more information and quotes for all of the companies that offer plans in your area. Call 1-855-954-0664 below or click below for help.

If you are new to all this and don’t know much about Medicare supplements yet, begin reading at the link below. we’ll walk you through the definitions.

To continue learning about Medicare supplements, click here: What is a Medicare Supplement?